What Does Paul B Insurance Mean?

Table of Contents6 Simple Techniques For Paul B InsurancePaul B Insurance Can Be Fun For AnyoneGetting My Paul B Insurance To WorkPaul B Insurance for Dummies

If there is clinical care you anticipate to require in the future that you have not required in the past (e. g., you're expecting your very first child), you may be able to get an idea of the prospective prices by consulting your current insurance provider's expense estimator. Insurers typically produce these type of tools to aid their participants purchase medical care.Equipped with info about existing as well as future medical demands, you'll be much better able to review your strategy choices by applying your approximated costs to the strategies you are taking into consideration. All the medical insurance intends gone over above include a network of medical professionals and hospitals, however the size and also range of those networks can vary, also for plans of the same kind.

That's since the health and wellness insurance firm has a contract for reduced rates with those specific providers. As gone over previously, some strategies will permit you to utilize out-of-network carriers, however it will cost you more out of your own pocket. Various other plans will certainly not cover any type of care obtained beyond the network.

It might be a fundamental part of your choice. Below's a summary of the suggestions supplied above: See if you're qualified for a subsidy, so you can identify what your costs will be as well as so you'll recognize where you need to shop. Evaluation your existing plan to understand exactly how it does or does not fulfill your demands, as well as maintain this in mind as you review your options.

What Does Paul B Insurance Do?

Obtain cases and treatment price data from your current insurance firm's participant site to understand previous and also potential future medical costs. Utilize this details to estimate out-of-pocket costs for the other strategies you're considering. Study the networks for the strategies you are taking into consideration to see if your favored physicians and medical facilities are included.

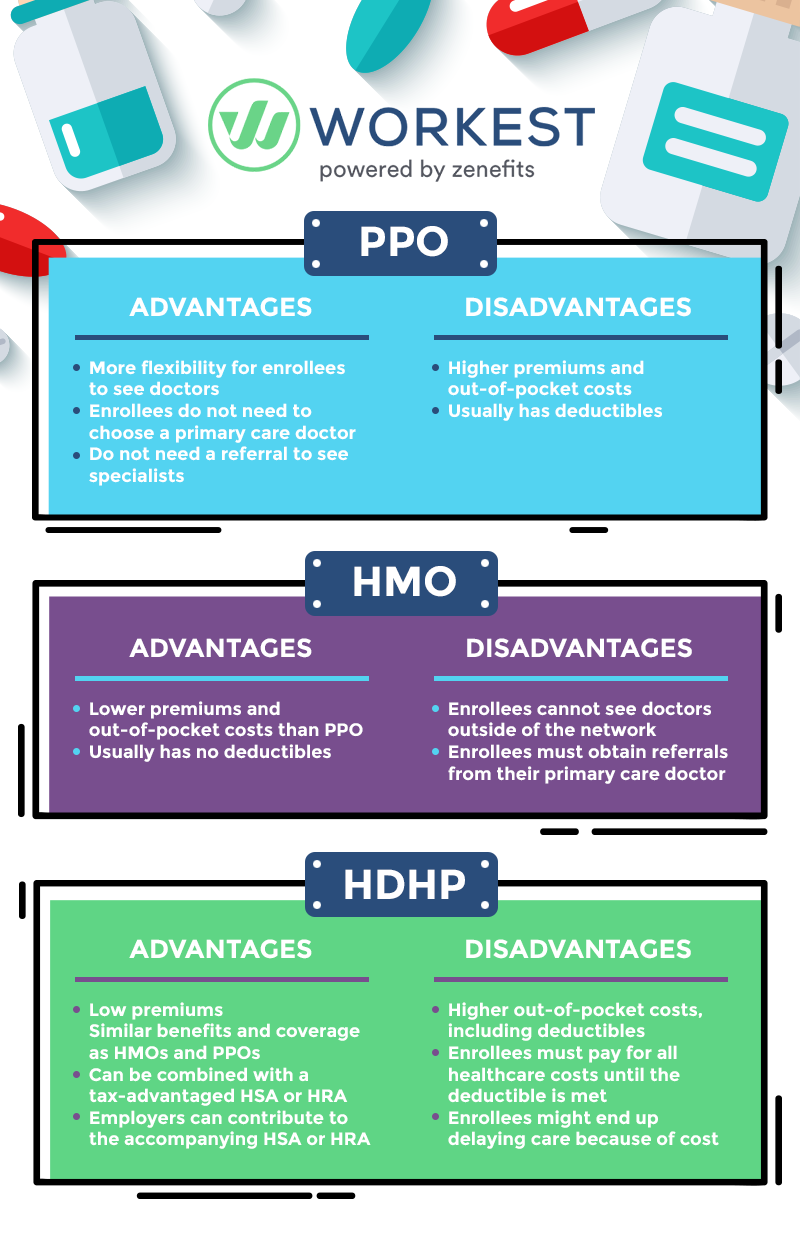

An FFS option that allows you to see medical providers that minimize their fees to the plan; you pay much less money out-of-pocket when you use a PPO provider. When you see a PPO you normally won't need to submit claims or documentation. Going to a PPO medical facility does not assure PPO advantages for all services obtained within that medical facility.

Normally enrolling in a FFS plan does not assure that a PPO will be offered in your area. PPOs have a more powerful visibility in some regions than others, as well as in locations where there are regional PPOs, the non-PPO benefit is the standard benefit.

Your PCP gives your basic medical treatment. The recommendation is a recommendation by your physician for you to be assessed and/or treated by a various medical professional or clinical professional.

Everything about Paul B Insurance

A Wellness Interest-bearing accounts allows individuals to pay for present health and wellness expenditures and also conserve for future competent clinical expenditures on a pretax basis. Funds transferred into an HSA are not exhausted, the balance in the HSA grows tax-free, as well as that amount is offered on a tax-free basis to pay clinical prices.

HSAs go through a variety of guidelines as well as limitations established by the Division of Treasury. Click Here Browse through Division of Treasury Resource Center to learn more.

They obtain to recognize you and your wellness requirements and can assist collaborate all your treatment. If you need to see a specialist, you are called for to obtain a referral.

Paul B Insurance Things To Know Before You Get This

If you currently have wellness insurance coverage from Friday Health Plans, your insurance coverage will certainly end on August 31, 2023. To remain covered for the rest of 2023, you should enlist in a brand-new plan. Get began

Workers have a yearly deductible they must satisfy before the medical insurance company home starts covering their medical costs. They may also have a copayment for certain services or a co-insurance where they are in charge of a percent of the overall costs. Solutions outside of the look at more info network commonly cause greater out-of-pocket costs.